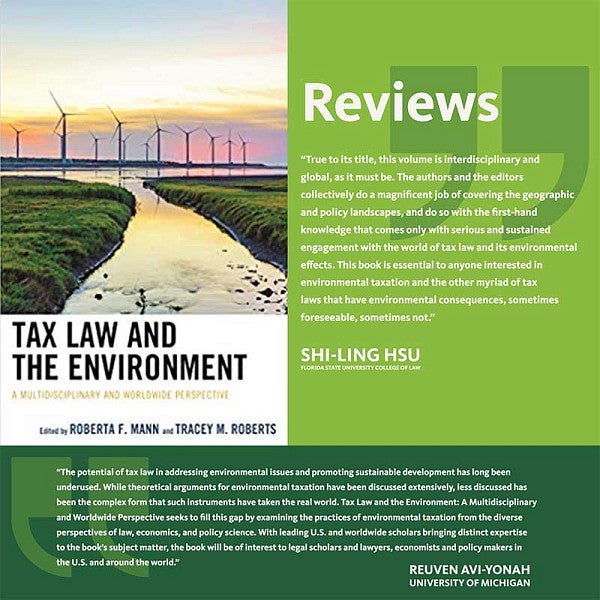

Professor Roberta Mann’s new book, Tax Law and the Environment: A Multidisciplinary and Worldwide Perspective, is an edited volume with co-editor Tracey M. Roberts of Samford University. The book takes a multidisciplinary approach to explore the ways in which tax policy can be used to solve environmental problems throughout the world. This 308-page book, available both digitally and in hardcover, was published by Lexington Books in 2018.

Professor Roberta Mann’s new book, Tax Law and the Environment: A Multidisciplinary and Worldwide Perspective, is an edited volume with co-editor Tracey M. Roberts of Samford University. The book takes a multidisciplinary approach to explore the ways in which tax policy can be used to solve environmental problems throughout the world. This 308-page book, available both digitally and in hardcover, was published by Lexington Books in 2018.

Climate change is a critical global issue. Solving it will take “all hands on deck.” Taxes are an important tool that can be used to help the environment. - Professor Roberta Mann

Oregon Law: What inspired you to write a book on this topic?

Professor Mann: I’ve written about the impact of tax law and the environment for 20 years, so I was thinking about an edited volume on the topic when a colleague, Tracey Roberts at Samford School of Law, wrote me to ask if I would co-edit a volume on tax law and the environment with her. Almost every year since 2002, I have attended the Global Conference on Environmental Taxation and I know many international scholars who write in the area. With this strong network, it was easy to find experts who could contribute to the book.

Oregon Law: What is environmental taxation?

Professor Mann: Environmental taxation encompasses policies like carbon taxes and tax credits for renewable energy, which encourage environmentally friendly activity. It could include policies like motor fuel taxes, which arguably have purposes other than improving the environment. A.C. Pigou, an economist from the early 20th century, argued that pollution generating activities constitute a market failure. That is, the market price of commodities such as coal does not reflect its true cost to society in terms of human health and environmental degradation. Pollution is thus an “external” cost, not borne by the industries who profit from the activity. Taxing pollution corrects that market failure by internalizing the social costs to the polluting industry.

Oregon Law: This book provides a detailed analysis of environmental taxation from around the world. What are the major similarities and differences that you found?

Professor Mann: What we found is that countries around the world are imposing costs on polluting activities. For example, Canada, Europe and certain Asian countries are taking serious action to reduce carbon emissions. The U.S. and Australia are lagging. Australia had a carbon tax, but it was repealed in 2014. The U.S. has never put a price on carbon, although we do provide some subsidies for renewable energy through tax credits. Tax credits for renewable energy are less efficient from an economic standpoint than carbon taxes for a variety of reasons. First, the tax credits are technology-specific — e.g. for electricity generated by solar, wind, biomass, etc. A carbon tax would be technology neutral, thereby leaving it to the market to determine the most efficient way to reduce carbon emissions. Second, tax credits may be awarded to behavior that would happen anyway. Finally, renewable energy tax credits, as currently structured in the U.S., may only be used by businesses with tax liability. As some renewable energy developers, particularly in the early stages of business development, do not have profits and therefore no tax liability, the use of the credit requires complex partnership structures.

Oregon Law: In what ways does this book explore the taxation and subsidization of both fossil fuels and renewable energy?

Professor Mann: In this book we explore how subsidies for fossil energy exacerbate the problem of free-riding pollution. Initially, petroleum was a miracle product which transformed the economy. The government considered incentives for exploration and production essential to this transformation. Now, fossil fuels are a mature industry and climate change requires a new economic transformation. We found that subsidizing fossil fuels is counterproductive to the goal of controlling climate change. Nonetheless, the subsidies for fossil energy continue, fiercely defended by industry interests.

Oregon Law: What are a few common misconceptions about this area of law?

Professor Mann: People tend to think of taxes as simply a means of generating government revenue. Few consider the impact of tax policy on the environment. I tell students that if they really want to help the environment, they should study tax law.

Oregon Law: What are some of the key things that you would like readers to take away from your book?

Professor Mann: As energy use is a major cause of environmental harm, the book explores the taxation of both fossil and renewable energy. Its analysis of both the past, the present and the future potential of environmental taxation will help policy-makers move economies towards sustainability, as well as informing students, academics, and citizens about tax solutions for pressing environmental issues.

Oregon Law: What differentiates your book from other tax law titles on the market?

Professor Mann: The book takes a multidisciplinary and multijurisdictional approach to tax law and the environment. It also provides a more detailed definition of environmental taxation, with examples from around the world.

By Rayna Jackson, School of Law Communications